Cryptocurrency Ownership Data

Learn about cryptocurrency adoption across the globe: trends, insights and statistics

Cryptocurrency Adoption is

Growing Worldwide

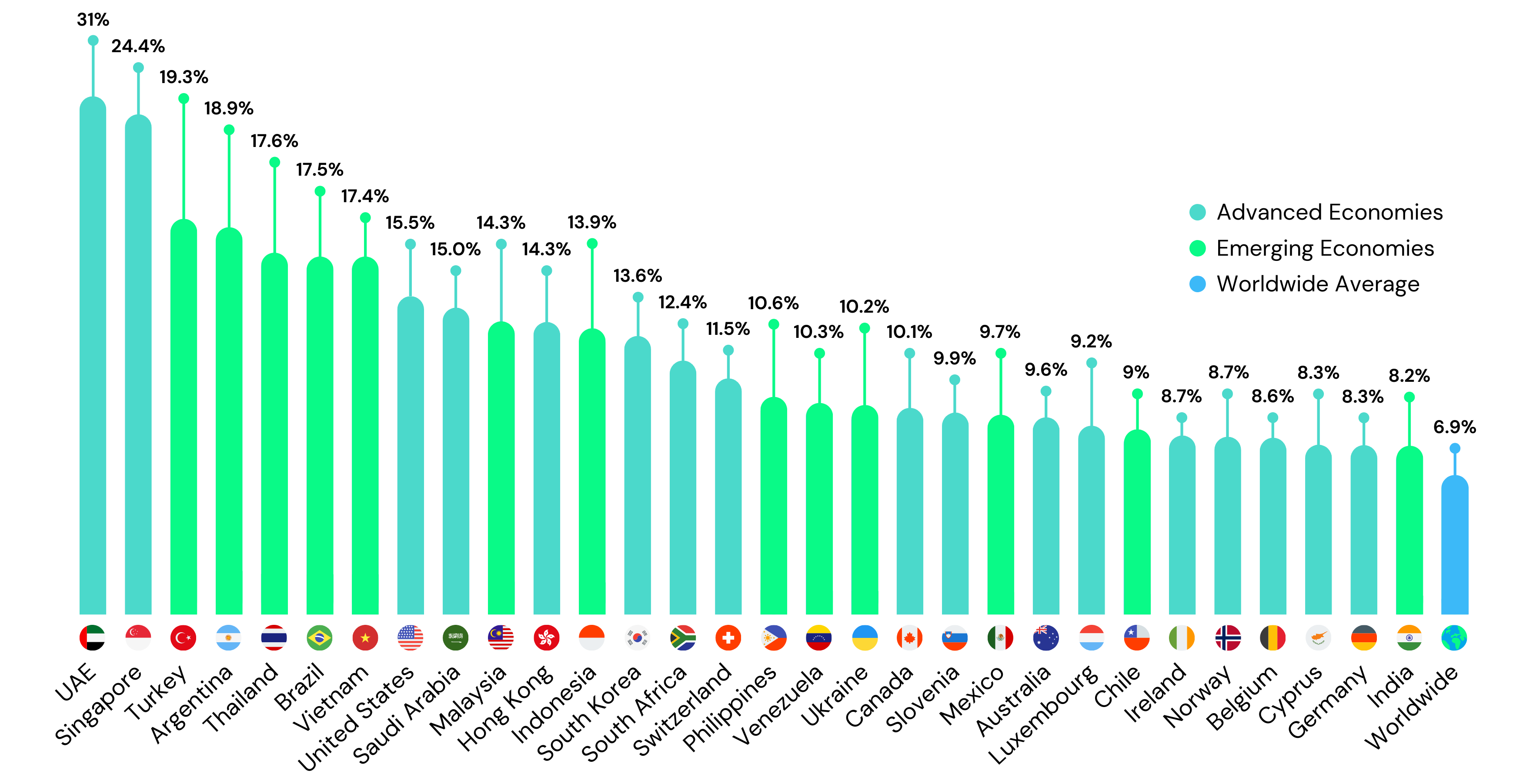

As a leading cryptocurrency payments company, we aim to provide key statistics to help businesses understand the market better and reach untapped opportunities. As of 2024, we estimated global cryptocurrency ownership at an average of 6.8%, with over 560 million crypto owners worldwide.

Over 560+ Million Cryptocurrency owners worldwide

Owners Demographics

61%

Male

39%

Female

34%

are aged between

25-34

65%

said they would like to make payments using crypto

Cryptocurrency Ownership Data

| Country | Data Year | Population | Ownership | Ownership Percentage | Report |

|---|---|---|---|---|---|

| India | 2023 | 1,428,627,663 | 93,537,015 | 6.55% | View Report |

| China | 2023 | 1,425,671,352 | 59,134,683 | 4.15% | View Report |

| United States | 2023 | 339,996,563 | 52,888,108 | 15.56% | View Report |

| Vietnam | 2023 | 98,858,950 | 20,945,706 | 21.19% | View Report |

| Pakistan | 2023 | 240,485,658 | 15,879,216 | 6.60% | View Report |

| Philippines | 2023 | 117,337,368 | 15,761,549 | 13.43% | View Report |

| Brazil | 2023 | 216,422,446 | 25,955,176 | 11.99% | View Report |

| Nigeria | 2023 | 223,804,632 | 13,261,259 | 5.93% | View Report |

| Iran | 2023 | 89,172,767 | 12,000,000 | 13.46% | |

| Indonesia | 2023 | 277,534,122 | 12,205,132 | 4.40% | View Report |

Cryptocurrency’s

Rapid Growth:

A Five-Year Surge

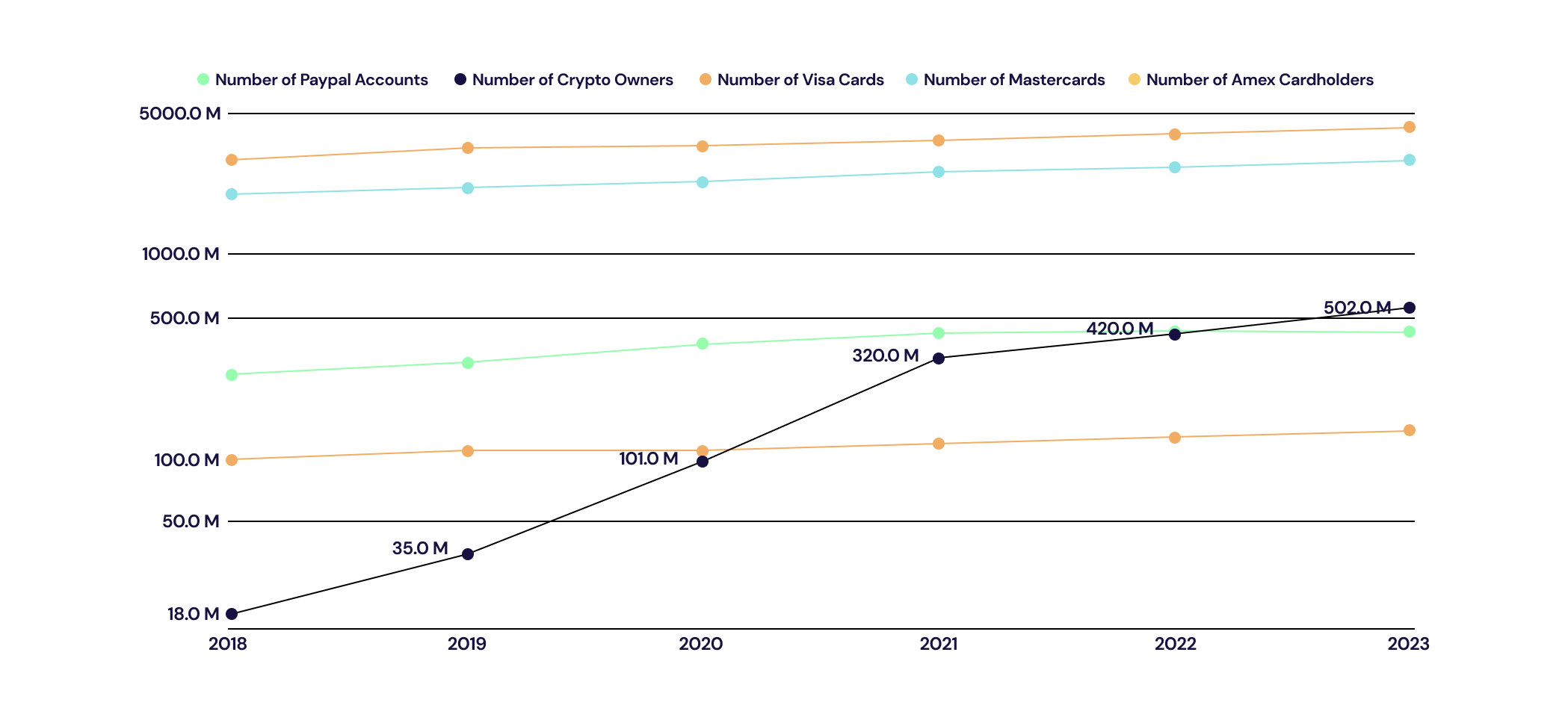

With a compound annual rate (CAGR) of 99% the growth in ownership of cryptocurrencies far exceeds the growth rate of traditional payment methods, which average at 8% from 2018 to 2023. In fact. within the same period, the growth rate for cryptocurrency ownership surpasses that of several payment giants such as American Express.

Source: Paypal, Visa, Mastercard, American Express